BLOGS

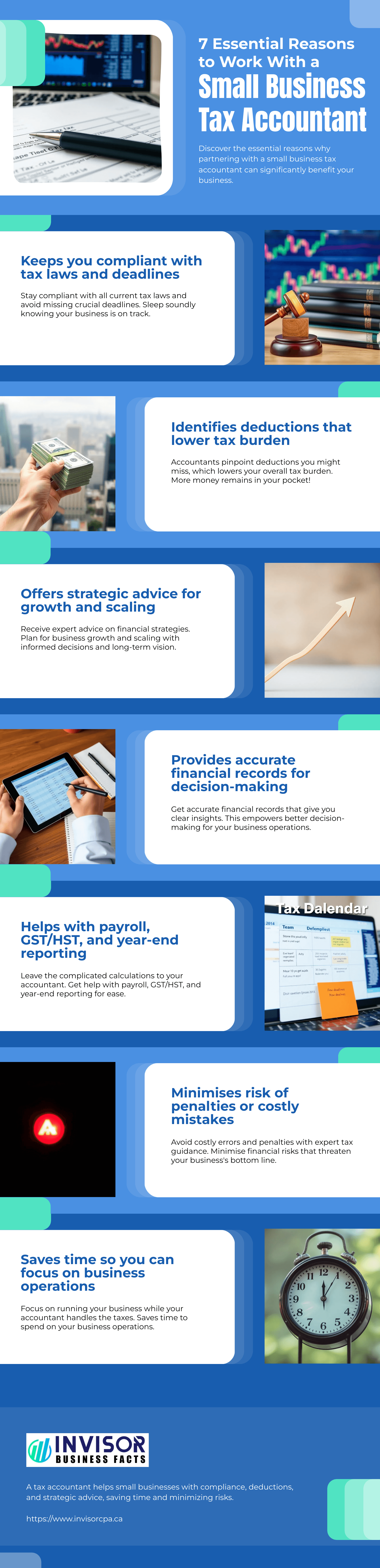

7 Essential Reasons to Work With a Small Business Tax Accountant

For entrepreneurs, managing taxes is one of the biggest responsibilities. While many owners attempt to handle it alone, a small business tax accountant ensures compliance, efficiency, and valuable savings. Their guidance helps simplify financial obligations while freeing time to focus on growth.

From payroll management to quarterly filings, the rules are detailed and time-sensitive. Missing deadlines or overlooking deductions can cost a business more than just money. It can damage credibility. Professional accountants not only prevent errors but also find opportunities that reduce the tax burden and improve financial health.

Working with an accountant also means better decision-making. By providing accurate reports and clear insights, they allow small business owners to confidently plan investments, expansions, and operational improvements without worrying about hidden financial risks.

Here is an infographic showing 7 essential reasons to work with a small business tax accountant.